Introduction

In the world of stock market investments, pharmaceutical companies have always been considered a safe bet due to the steady demand for healthcare products. One such company that has been gaining attention in recent years is the Indian pharmaceutical giant, Mankind Pharma. For those looking to diversify their investment portfolio with shares in the pharmaceutical sector, Mankind Pharma might be a suitable option. This article aims to provide a comprehensive guide for beginners on investing in Mankind Pharma shares.

About Mankind Pharma

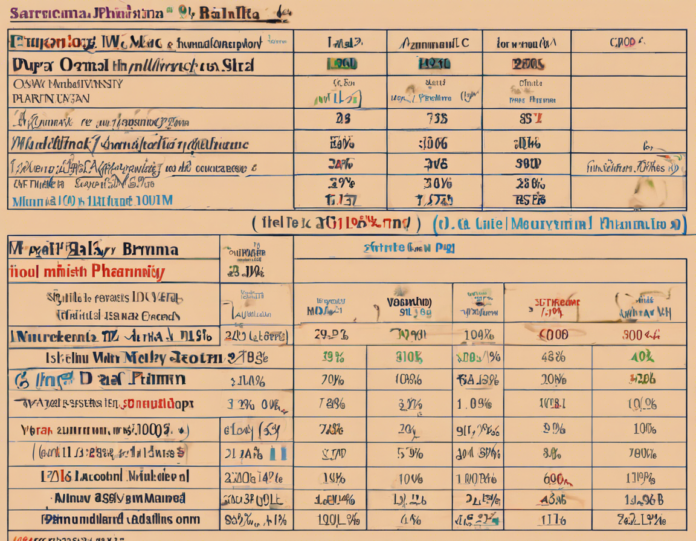

Established in 1995, Mankind Pharma has emerged as one of the leading pharmaceutical companies in India. The company has a diverse portfolio of products ranging from pharmaceuticals and over-the-counter medications to healthcare and wellness products. With a strong focus on research and development, Mankind Pharma has been able to introduce a wide range of innovative products to cater to the needs of a diverse customer base.

Why Invest in Mankind Pharma Shares?

- Steady Growth: Mankind Pharma has shown consistent growth over the years, making it an attractive option for long-term investments.

- Diversified Portfolio: The company’s diverse product portfolio provides stability against market fluctuations.

- Strong Market Presence: With a strong presence in the Indian pharmaceutical market, Mankind Pharma is well-positioned to capitalize on the growing healthcare industry.

- Focus on Innovation: Mankind Pharma’s commitment to research and development ensures a pipeline of new products, which could drive future growth.

- Robust Financial Performance: The company’s strong financial performance and revenue growth make it an appealing choice for investors.

How to Invest in Mankind Pharma Shares

- Open a Demat Account: Before investing in Mankind Pharma shares, you need to open a Demat account with a registered broker.

- Research the Company: Conduct thorough research on Mankind Pharma, including its financial performance, market position, and future prospects.

- Monitor Market Trends: Keep an eye on market trends and news related to the pharmaceutical industry to make informed investment decisions.

- Consult a Financial Advisor: If you are new to investing, it is advisable to seek guidance from a financial advisor who can help you navigate the complexities of the stock market.

- Stay Informed: Regularly track the performance of your investments and stay informed about any developments related to Mankind Pharma or the pharmaceutical sector.

Risks Associated with Investing in Mankind Pharma Shares

- Regulatory Changes: Like any pharmaceutical company, Mankind Pharma is subject to regulatory changes that could impact its operations and financial performance.

- Competition: The pharmaceutical industry is highly competitive, and Mankind Pharma faces competition from both domestic and international players.

- Market Volatility: Stock prices can be volatile, and external factors such as economic conditions and market trends can influence the value of Mankind Pharma shares.

- Sector-specific Risks: The healthcare sector is influenced by factors such as drug approvals, patents, and healthcare policies, which could affect Mankind Pharma’s business.

- Currency Fluctuations: Mankind Pharma operates in multiple countries, exposing it to currency risks that could impact its earnings.

FAQs (Frequently Asked Questions)

1. Is Mankind Pharma a publicly traded company?

Yes, Mankind Pharma is a publicly traded company listed on the stock exchanges in India.

2. How can I buy Mankind Pharma shares?

You can buy Mankind Pharma shares through a registered broker by opening a Demat account.

3. What is the dividend history of Mankind Pharma?

Mankind Pharma has a history of paying dividends to its shareholders, with the dividend amount varying each year based on the company’s performance.

4. How can I track the performance of my Mankind Pharma investments?

You can track the performance of your Mankind Pharma investments through your Demat account, which provides real-time updates on stock prices and portfolio value.

5. What factors should I consider before investing in Mankind Pharma shares?

Before investing in Mankind Pharma shares, consider factors such as the company’s financial performance, market position, growth prospects, and overall health of the pharmaceutical industry.

In conclusion, investing in Mankind Pharma shares can be a lucrative opportunity for those looking to diversify their investment portfolio with a stable and growing pharmaceutical company. However, it is essential to conduct thorough research, stay informed about market trends, and consider the risks associated with investing in the pharmaceutical sector. By following the guidelines outlined in this article, beginners can make informed decisions when investing in Mankind Pharma shares.